India’s smartphone market grew by 8% in volume and 18% in wholesale value year-over-year (YoY) in Q2 2025, showing a strong recovery after a slow Q1. According to Counterpoint’s Monthly India Smartphone Tracker, this growth was fueled by a 33% increase in new smartphone launches, aggressive marketing, strong summer sale performance, attractive discounts, easy EMI options, and bundled offers – especially in the mid-range and premium segments.

Senior Research Analyst Prachir Singh noted that India’s smartphone market recovery in Q2 2025 was supported by a stronger macroeconomic environment. Falling retail inflation, repo rate cuts, and earlier tax relief measures improved consumer confidence, boosted savings, and made financing more accessible – leading to higher smartphone spending.

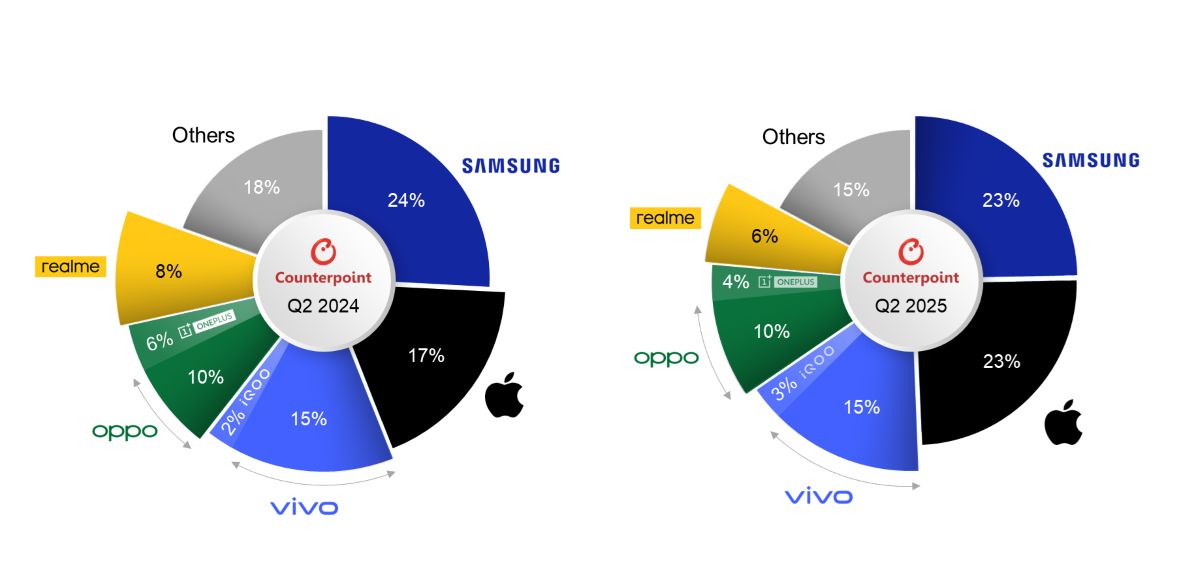

He also mentioned that growing consumer confidence drove a 37% YoY growth in the ultra-premium smartphone segment (above ₹45,000), making it the fastest-growing price tier. Apple and Samsung led the ultra-premium growth, with the iPhone 16 emerging as the most-shipped smartphone in the quarter. Apple achieved its highest-ever Q2 shipments in India, while Samsung led in market value share at 23% and ranked second in units shipped, driven by strong demand for its Galaxy A and S series.

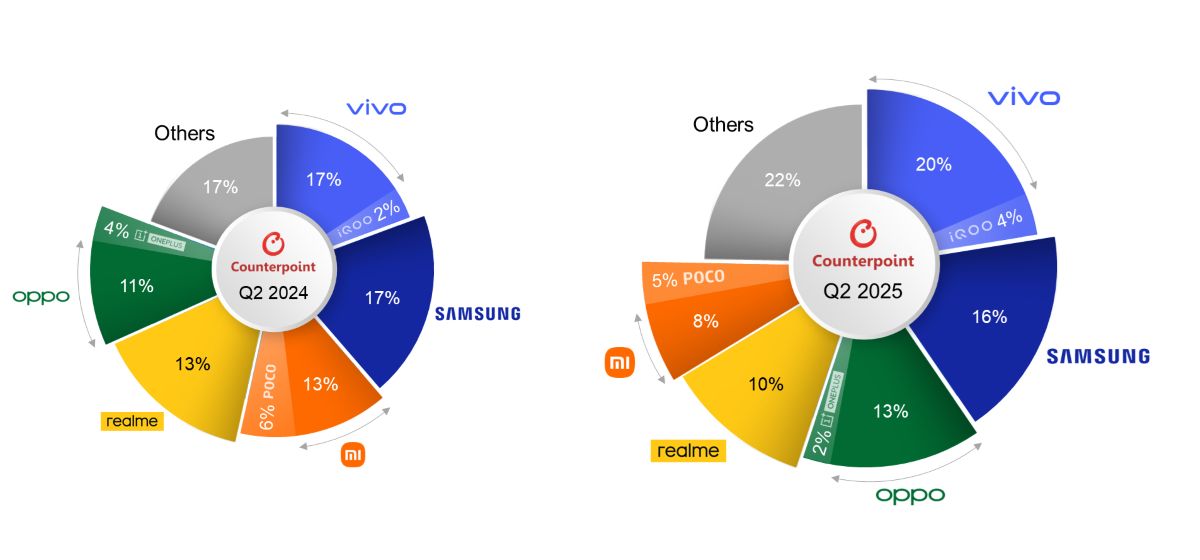

Vivo (excluding sub-brand iQOO) led the India smartphone market in Q2 2025 in terms of units shipped, driven by high demand in the ₹10,000–₹15,000 price range, where its Y and T series performed well. OPPO secured the third spot, boosted by the success of its new A5 and K series smartphones.

OnePlus recorded a 75% YoY growth in the ultra-premium segment during Q2 2025, thanks to strong sales of the OnePlus 13, 13R, and the compact OnePlus 13s model. Realme also entered the high-end segment with the GT 7 Pro Dream Edition, targeting younger consumers. The brand has been expanding its offline presence to boost visibility and scale its higher ASP models. Meanwhile, Nothing was the fastest-growing smartphone brand in India, with a 146% YoY surge in shipments, driven by the launch of the CMF Phone 2 Pro and rapid retail expansion.

Motorola’s smartphone shipments rose by 86% YoY in Q2 2025, driven by strong demand for its G and Edge series in the mid-range segment. The brand also benefited from expanded distribution and deeper retail penetration in smaller cities. Lava emerged as the fastest-growing Indian smartphone brand with 156% YoY growth, powered by competitive launches under ₹10,000, a clean stock Android experience, and improved after-sales service.

MediaTek led the smartphone chipset market in India with a 47% share in Q2 2025, followed by Qualcomm at 31%. Qualcomm also saw a 28% YoY increase in smartphone shipments, reflecting strong demand for its processors across various device segments.